…from Perspectives to Solutions…

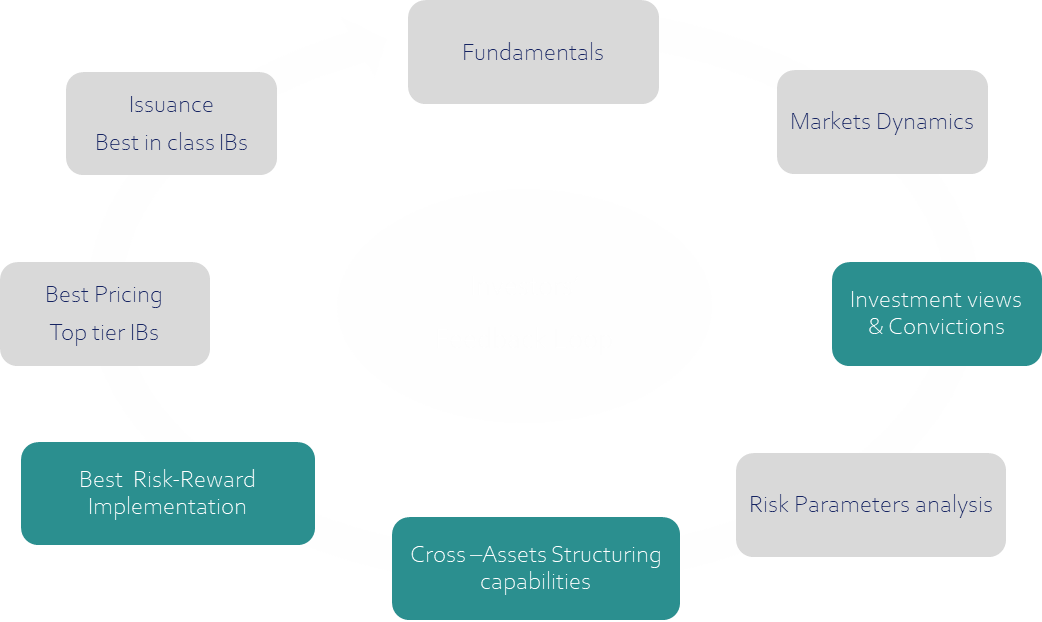

The combination of our expertise in asset management and investment banking allows us to design and distribute optimal investment solutions for the needs and constraints of our clients.

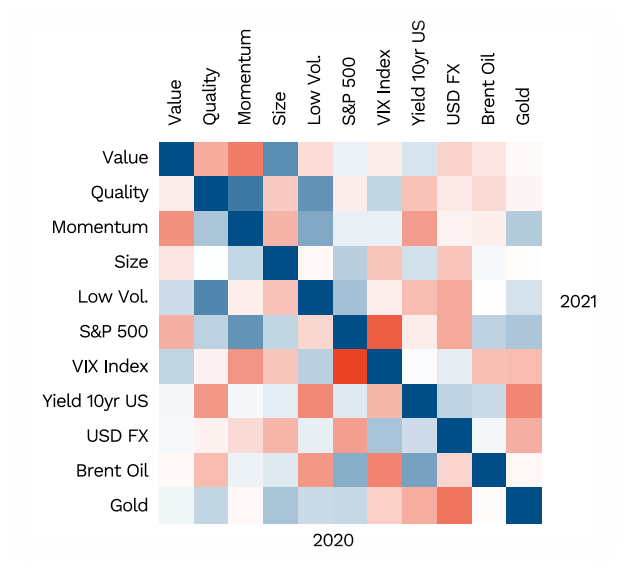

30 years of low inflation and lower interest rates have resulted in an outperformance of financial assets.

This has led investors to ever more leverage and exposure to find yield.

As monetary expansion is not infinite and the zero interest rate policy is coming to an end, a paradigm shift is underway.

Our experience in markets and risk management, our independence of view and our global cross-asset vision allow us to approach this new situation with multiple advantages.

Customer feedback is at the heart of our value creation process.

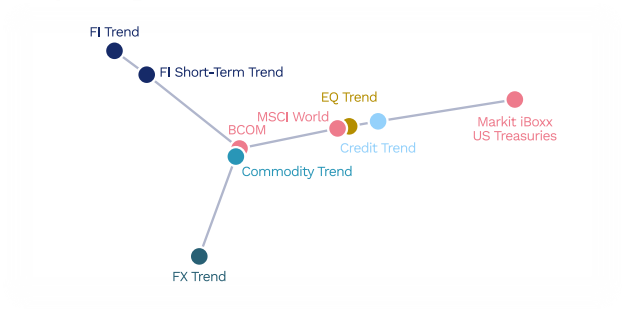

We offer cross-asset solutions in line with market themes identified internally.

Our organization and the quality of our partners ensure a perfect execution with the objective of offering the optimal product in connection with the selected theme.

A single point of entry for investors :

✓ Internal and independent research and analysis

✓ Design and construction of tailor-made investment solutions

✓ Access to state-of-the-art tools for asset allocation, pricing, back-testing, risk management and reporting…

Advice in asset allocation, portfolio management, solution design :

✓ Participation, yield, coverage…

✓ On diversified wrappers : Bonds, Notes, Warrants, Certificates…

✓ With thematic, diversified or specific strategies…

360° support on Structured Products. Omen Partners allows you to design with us, then distribute to your customers, investment solutions that stick to your DNA:

✓ Developed and mature business in Switzerland and in Luxembourg

✓ Business at its infancy in France, but activity picking up fast

✓ Issued by leading Investment Banks

✓ All asset classes and strategy types

✓ Fast « Go to Market »

✓ Transparent and Liquid

✓ Reduced issuance and launch costs

✓ Reduced management costs

Omen Partners offers 360° support on AMCs

✓ Design of the investment strategy (thematic, cross-assets, risk premia etc …)

✓ Selection of the issuer

✓ Asset Allocation Advisory service

✓ Monitoring of the risk-lifetime return of the product

✓ Valuation control

✓ Reporting

Global Markets (sell-side) & Asset Management (buy-side)

✓ Strategies : Investment – Relative Value – Hedging

✓ Geographical Areas : US – Europe – Asia

✓ Product Types : Cash – Derivative Listed /OTC – Complex flow…

✓ Asset Classes : Equities – Rates – Credit – Currencies – Commodities – Real Estate – Real Assets…

In-house skills

✓ Global-Macro & Market dynamics analysis

✓ Cross-asset & complex-flow trading

✓ Financial engineering

✓ Asset allocation and portfolio construction

✓ Quantitative analysis and risk management

Pierre Martin : Pierre Martin : 28 years in Investment Banking and cross-assets structured solutions sales. BNP Paribas : Head of the French Distribution Team, Head of the “Premium Group” in charge of sales to the largest European Institutions distributing structured solutions . TP Icap : co-founder and co-head of the investment solutions activities.

The accompaniment in the investment process is done via two channels

Partnerships to build and distribute solutions

✓ Asset Managers

✓ Wealth Managers and Private Banks

✓ IFAs Networks

Direct distribution of Omen Partner solutions

✓ Institutional Investors

✓ Asset Managers and Alternative Funds

✓ Family Offices